How To Find Income Tax Refund Sequence Number

If you have paid college taxation to the authorities in the previous financial year (FY), i.east., FY 2019-20, then you are required to file your income tax return (ITR) to merits the refund amount. Higher revenue enhancement is normally paid when during the financial yr the advance tax paid past an individual, self-assessment and/or tax deducted at source (TDS) is more than their tax liability.

If the taxation department determines, after processing your ITR, that a refund is payable to you, an intimation is sent to yous via SMS and email. The intimation received past you shows the amount of refund that will be credited into your business relationship along with a refund sequence number. An intimation is sent to you under section 143 (1) of the income revenue enhancement Act.

Also read: How to file ITR? Here'due south the complete guide

The refund is processed by the Land Bank of India (SBI).The refund is sent to the taxpayer either by straight credit it into their business relationship via RTGS/NEFT or by issuing a bank check or demand typhoon and sending it to the taxpayer'due south registered address. Practice make sure that you have filled in the correct bank business relationship details while filing your ITR as the refund volition be credited to this business relationship.

Nevertheless, from March one, 2019 onwards, the tax department volition but effect due east-refunds to those bank accounts where PAN is linked and is pre-validated on the eastward-filing website.

Also Read: Pre-validate your banking concern business relationship to become income tax refund

Ways to rail condition of income tax refund

Abhishek Soni, CEO, Tax2Win.in, a revenue enhancement filing website, explains that there are two means one tin can track their income tax refund status.

These are as follows:

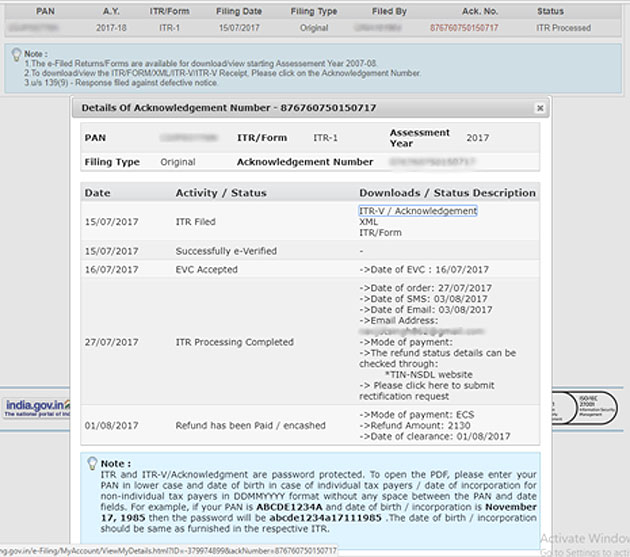

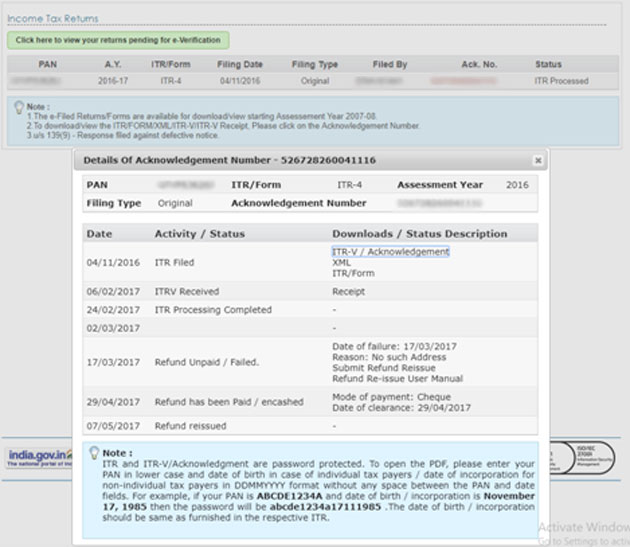

a) On the income tax eastward-filing website

b) On the Tin can NSDL website

- On the east-filing website

To cheque the status of your revenue enhancement refund, yous are required to have the following steps:

1. Visit website: www.incometaxindiaefiling.gov.in

2. Login to your account by entering these details: PAN, password and captcha code.

3. Click on 'View Returns/Forms'

4. Select 'Income Revenue enhancement Returns' from the drib down carte du jour and click on submit.

five. Click on your acknowledgement number, which is a hyperlink to the relevant assessment twelvemonth on the system. For FY 2019-20, the assessment year is AY 2020-21.

6. A new webpage will announced on your screen showing complete details of your ITR filing - from the appointment of ITR filed to ITR processed and date of issuing refund.

7. Along with that it will likewise testify details like assessment twelvemonth, condition, reason for failure, if any, and mode of payment.

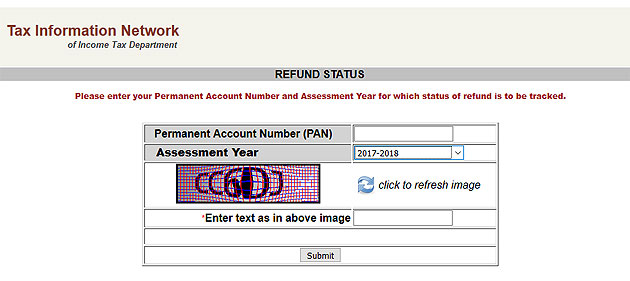

- On the TIN NSDL website

Alternatively, one tin check the status of the income tax refund on the Tin NSDL website too. Refund status is available on the website ten days after the refund has been sent by the department to the bank, i.east., SBI.

This is how you can check the status of your income tax refund hither:

one. Visit the website: https://tin can.tin.nsdl.com/oltas/refundstatuslogin.html

2. Enter your PAN details

three. Select the relevant cess year for which you want to check the refund status.

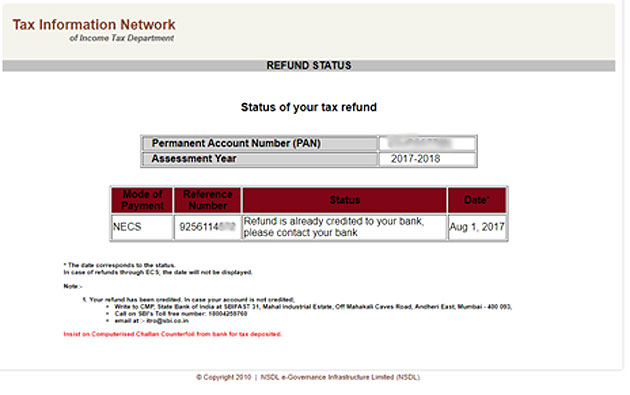

4. Enter the captcha lawmaking and click on submit. Depending on the status of your refund, a bulletin volition be displayed on your screen.

What the status bulletin means

Like mentioned above, you will get a message depending on your refund status; this is the example with the income tax e-filing and the TIN-NSDL websites. Messages displayed are as follows:

i) Refund Status - Expired: This means that the refund cheque received by y'all was not deposited in the bank within the stipulated time. The validity of a cheque is ninety days during which a taxpayer is required to submit the cheque to the bank to receive the payment. In such a scenario, a taxpayer is required to submit 'refund re-issue request' on the e-filing portal.

ii) Refund Condition - Refund Returned: There are two reasons why this happens. If the income revenue enhancement refund is sent to you via ECS (electronic clearing service), the payment transfer will not happen if you accept given the wrong banking concern business relationship details.

A cheque or demand draft tin can get returned because y'all accept given the wrong accost or your house was locked.

iii) Refund Status - Processed through direct credit but failed: It ways that SBI had initiated to straight credit the refund amount only failed due to any of the following possible reasons:

1. Account had been closed;

two. Operations in the account had been stopped /restricted /On Hold;

3. It is account fixed deposit, loan, or Public Provident Fund (PPF) account;

4. It is a non-resident Indian (NRI) account;

five. The account holder may be deceased;

6. Account details are incorrect

iv) Refund Status - Refund processed through NEFT/NECS but failed: It means that refund processed through NECS/NEFT mode has failed. In this case, a taxpayer should verify the account number, account clarification, MICR/IFSC code given at the fourth dimension of filing of render.

five) Refund Status - Adjusted against outstanding demand of previous yr: This means that refund for the current year had been adapted against outstanding demand of the previous assessment year either in-office or total. The tax department has full authority, under department 245, to do this. Yet, such an activeness can be done only later on giving an intimation in writing to the taxpayer regarding the action proposed to exist taken.

6) ECS refund advice received but non reflecting in your bank business relationship: It may and so happen that you have received an e-mail from SBI with details of the refund amount credited into your account. The ECS advice volition bear witness beneficiary name, account number, IFSC/MICR code, NEFT UTR Number or NECS sequence number etc. equally displayed on the Tin can website. In case the same amount does not reflect in your bank account then delight check with your bank whether the corporeality has been credited to the wrong account. Yous can also send an electronic mail to itro@sbi.co.in for information.

Refund re-consequence request

In case you are required to submit a refund re-issue request due to any of the errors mentioned to a higher place, you lot tin can exercise it by taking the following steps:

i. Visit income revenue enhancement e-filing website: www.incometaxindiaefiling.gov.in

2. Click on 'My Business relationship' tab and select the 'Service Asking' selection.

3. Select request type as 'New Request' and request category as 'Refund Reissue'.

four. A new screen will appear showing details such as PAN, return type, assessment year, acknowledgement number, advice reference number and response.

5. Click on 'Submit'.

6. You lot volition exist required to submit your banking concern and address details.

7. You will take to undergo a verification process using an electronic verification lawmaking (EVC) or digital signature certificate (DSC) to complete the process.

Source: https://economictimes.indiatimes.com/wealth/tax/how-to-check-income-tax-refund-status/articleshow/60968174.cms

Posted by: stewartonves1995.blogspot.com

0 Response to "How To Find Income Tax Refund Sequence Number"

Post a Comment